Thursday, 15 January 2026

Rare Twins Born to Mountain Gorilla Family in Virunga National Park

Wednesday, 24 December 2025

Egypt Becomes 26th Country to Eliminate Leading Cause of Infectious Blindness with Triumph Over Trachoma

Monday, 29 September 2025

Priyanka Chopra Jonas’ African holiday is all about wildlife, good food

Wednesday, 4 June 2025

A free clinic for donkeys, vital to Ethiopia's economy

Wednesday, 5 February 2025

Indian American says he’s solved the mystery behind 4,500 years old Egyptian Pyramids

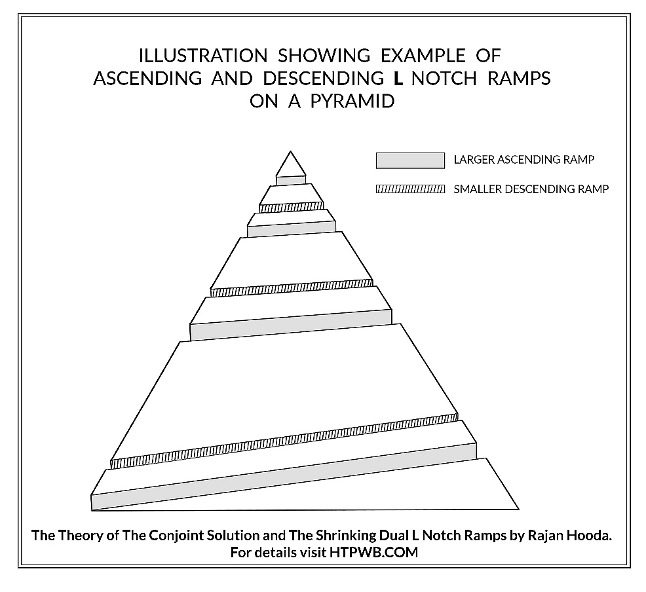

This was now used to transport stones to build the third layer. This process was repeated 209 times till the pyramid was finished. Then, starting from the top, the highest level of the ramp was removed, and the missing stones of level 209 were put into place to finish this level,” he added. “This reverse process of ramp removal and placement of missing stones was repeated 209 times ending in the lowest level being completed last. Because the ramp used is not an exterior ramp, nor an interior one, it is an ‘L Notch Ramp’ since it is built like a cut-out notch within the footprint of each layer of stones.”Hooda proposed that the ancient Egyptians likely used a dual “L Notch Ramp,” system for pyramid construction, with one ramp for moving stones upward and a smaller ramp for workers to descend. This method, which left no visible traces after the ramps were dismantled, helps explain the long-standing mystery of Egyptian pyramids logistics.His painstaking research also highlights evidence of this approach, such as the smaller stones used at the pyramid’s higher levels—a design compromise necessitated by the L Notch Ramp system. It also identifies eight interlocking components that form an integrated explanation for the construction, providing comprehensive proof of the method.

This was now used to transport stones to build the third layer. This process was repeated 209 times till the pyramid was finished. Then, starting from the top, the highest level of the ramp was removed, and the missing stones of level 209 were put into place to finish this level,” he added. “This reverse process of ramp removal and placement of missing stones was repeated 209 times ending in the lowest level being completed last. Because the ramp used is not an exterior ramp, nor an interior one, it is an ‘L Notch Ramp’ since it is built like a cut-out notch within the footprint of each layer of stones.”Hooda proposed that the ancient Egyptians likely used a dual “L Notch Ramp,” system for pyramid construction, with one ramp for moving stones upward and a smaller ramp for workers to descend. This method, which left no visible traces after the ramps were dismantled, helps explain the long-standing mystery of Egyptian pyramids logistics.His painstaking research also highlights evidence of this approach, such as the smaller stones used at the pyramid’s higher levels—a design compromise necessitated by the L Notch Ramp system. It also identifies eight interlocking components that form an integrated explanation for the construction, providing comprehensive proof of the method.- Remarkable Efficiency: No external construction needed.

- Genius Simplicity: Requires only simple technology of small ramps.

- Innovative L Notch Ramp: A unique dual-purpose interior/exterior design.

- Elegant Logistics: Two ramps ensure one-way, efficient transport of stones and labor.

- Methodological Invisibility: This technique leaves no evidence of its use/methodology.

- Significant Design Compromise: Smaller stones at the top were essential; No other building method requires this compromise.

- Shrinking L Notch Ramps: A necessity for the highest levels, forcing the design compromise.

- Complete Problem Definition: The Conjoint Solution and The Shrinking Dual L Notch Ramps connect/resolve all the pieces of the pyramids puzzle.

Thursday, 22 August 2024

India, Africa are striving for better quality life for their people

Thursday, 20 June 2024

De Kock leads South Africa to 194-4 against USA at T20 World Cup

Friday, 14 June 2024

The world is rushing to Africa to mine critical minerals like lithium – how the continent should deal with the demand

Global demand for critical minerals, particularly lithium, is growing rapidly to meet clean energy and de-carbonisation objectives.

Africa hosts substantial resources of critical minerals. As a result, foreign mining companies are rushing to invest in exploration and acquire mining licences.

According to the 2023 Critical Minerals Market Review by the International Energy Agency, demand for lithium, for example, tripled from 2017 to 2022. Similarly, the critical minerals market doubled in five years, reaching US$320 billion in 2022. The demand for these metals is projected to increase sharply, more than doubling by 2030 and quadrupling by 2050. Annual revenues are projected to reach US$400 billion.

In our recent research, we analysed African countries that produce minerals that the rest of the world has deemed “critical”. We focused on lithium projects in Namibia, Zimbabwe, the Democratic Republic of Congo (DRC) and Ghana. We discovered these countries do not yet have robust strategies for the critical minerals sector. Instead they are simply sucked into the global rush for these minerals.

We recommend that the African Union should expedite the development of an African critical minerals strategy that will guide member countries in negotiating mining contracts and agreements. The strategy should draw from leading mining practices around the world. We also recommend that countries should revise their mining policies and regulations to reflect the opportunities and challenges posed by the increasing global demand for critical minerals.

Otherwise, African countries that are rich in critical minerals will not benefit from the current boom in demand.

What are critical minerals?

There is no universal consensus on what critical minerals are. Various regions and institutions have different lists of critical minerals, and the contents of these lists keep changing. For instance, Australia has classified 47 minerals as critical. The European Union has identified a list of 34 critical raw materials that are important to the EU economy and face a risk of disruption. The US critical minerals list contains 50 elements, 45 of which are also considered strategic minerals.

Each country or region has reasons why these minerals are classified as critical. For most western countries, minerals are critical if they

are essential for a low carbon economy or for national security

have no substitutes

are vulnerable to supply chain disruption.

Lithium projects in Africa

At the time of our research there were 18 lithium projects at various stages, from early-stage exploration to production, across Africa. We focused on those in Namibia, Zimbabwe, the DRC and Ghana.

Our research revealed that conversations on Africa’s critical minerals had largely been shaped by geostrategic and economic opportunities arising from demand from western countries and China. Less attention was paid to the supply chains African countries should secure for current and future industrial applications.

We realised that these countries contributed little to global carbon emissions and their economies were not driven by industrialisation. The current inadequate infrastructure and policies to deal with the repercussions of lithium mining, for example, underscored the lack of a clear agenda. Lithium mining has impacts on communities, biodiversity, water sources and energy usage.

We also discovered that with over 30% of the world’s critical minerals deposits, African countries could become major global suppliers. They could also trade among themselves to avoid potential supply chain disruption or even monopoly by countries outside Africa.

Our research also highlights that emerging lithium mining in Zimbabwe, the DRC and Namibia is reinforcing and breeding new forms of corruption and illegality in the resources sector. Ghana is still in the early stage of setting up its lithium sector.

What is the way forward?

Africa needs stronger resources governance: regulations, accountability and transparency. Mining policies and regulations must reflect the opportunities and challenges of meeting global demand for critical minerals. Mining companies operating in African countries should adhere to leading mining practices and national regulations to minimise the environmental and social impacts of their operations.

The claim that it is urgent to acquire critical minerals must not be an excuse for African governments and foreign mining companies to bypass mining and environmental regulations. Rather, the urgency claims should give African governments greater power to make mining deals that will benefit people and the environment.

For these countries to use the economic opportunities arising, there must be incentives for local companies to mine and process lithium before exporting it. Processing of lithium in the country of origin would increase local returns, create jobs, and drive the growth of other sectors of the economy.

There is a need for coordinated efforts in Africa to build local capacity along the mining chain, from exploration to the market. There’s an opportunity also to build industries to support the global de-carbonisation agenda. An example would be manufacturing electronic vehicle batteries. In this way, Africa would not only be a source of raw materials, but a competitive source of low carbon products.

These are some key lessons for African countries.![]()

James Boafo, Lecturer in Sustainable Development, Murdoch University; Eric Stemn, Lecturer, Safety and Engineering, University of Mines and Technology; Jacob Obodai, Postdoctoral Research Assistant, Edge Hill University, and Philip Nti Nkrumah, Researcher, Sustainable Minerals Institute, The University of Queensland

This article is republished from The Conversation under a Creative Commons license. Read the original article.

Thursday, 30 May 2024

World Bank donates $100 Million to boost education sector

Dr. Jacob Korok Majiu, Deputy Minister of Information, told the media after the Council of Ministers meeting.

He said the funds would be used to improve teacher’s training and construct schools throughout the country.

“The money will be used to boost the capacity of the teachers and the construction of schools throughout the country,” Dr. Majiuk explained. He added that the Ministry is working with the World Bank to launch the initiative upon receiving the funds.

This significant donation aims to address long-standing challenges in South Sudan’s education system. By enhancing teacher training and expanding school infrastructure, the World Bank’s contribution is expected to have a positive long-term impact on the country’s education sector.World Bank donates $100 Million to boost education sector

Wednesday, 29 May 2024

Uganda looks to potential uranium production

.jpg?ext=.jpg)

Sunday, 19 May 2024

How Continental Competition Policy Strengthens the African Marketplace

- By Chilufya Sampa: Regional price distortions hurt small traders the most; as more states adopt competition rules, it's the traders and consumers who will win big.

- National economies may reign supreme, but cross-border trade remains vibrant across Africa. Markets are interconnected. A drought in one country will impact the price of maize in a neighbouring country. Businesses understand this dynamic and often operate on a regional basis. Take an example: traders buy soybeans in Malawi and Zambia to then sell them in Kenya.

- When markets work well, everyone benefits. Barriers to entry are lowered, benefiting micro and small business, while consumers can access a variety of goods at lower prices. But when large, and vertically integrated suppliers operate across borders and abuse their dominant market position, they earn excessive margins. Looking at soybeans again, the African Market Observatory showed that traders earned a mark-up of up to 91% by suppressing farmer prices in Malawi and Zambia and increasing prices to buyers in Kenya.

- This is where competition authorities would ordinarily step in to enforce market rules. Yet, a recent report by the Shamba Centre for Food & Climate reveals that nearly half the countries in sub-Saharan Africa lack competition laws and institutions. This has dire consequences. Markets become pawns in the hands of a few businesses, which dictate how those markets operate, thus defeating the principles of open markets and competition. In many instances, such businesses determine prices - whether buying or selling - to their benefit.

- In the agriculture sector, it leads to poverty and food insecurity. Small food producers are squeezed; they face higher prices for their supplies and lower prices for their goods and often exit these markets. Data confirms this sad reality. In African cities, food prices are on average more than 30% higher compared with low- and middle-income countries in other parts of the world.

- But it is not all bad news.

- In sub-Saharan Africa, a vibrant competition landscape is emerging. Nine countries have strong competition regimes in place with a history of enforcing case law while a further 17 countries have nascent competition authorities in place. Increasingly, these national authorities are turning towards regional competition organisations to strengthen their capabilities. Improved cooperation among competition organisations on advocacy and investigations is leading to better enforcement.

- Leveraging regional African institutions and enforcement is a first step towards building a strong, continent-wide, competitive market. Better coordination and cooperation between regional competition authorities and national authorities is needed to help regulate cross-border anti-competitive behaviour and reinforce the capabilities of national authorities. This is of particular importance for countries that currently do not have competition laws or institutions in place.

- A win-win situation

- Regional economic communities, such as the Common Market for Eastern and Southern Africa (COMESA) and the West African Economic and Monetary Union (WAEMU), have an essential role in tackling regional anti-competitive conduct.

- For example, the COMESA Competition Commission has demonstrated how it can regulate cross-border competition as well as support national authorities in their work. It recognizes that competition enforcement at the regional level cannot be effective if national authorities are weak. As such, it helps to develop national competition laws, strategic plans and internal capacity. It sponsors training and can, upon request, review competition conduct and mergers.

- Yet, COMESA relies on national competition authorities to provide data and the knowledge to help other national regulators. Through COMESA, for example, the Zambian regulator provided support to national authorities in Ethiopia, Malawi, Seychelles and Eswatini. National authorities are the building blocks for regional competition enforcement.

- Reviewing cross border mergers

- COMESA has been active in regulating cross-border competition through the review of mergers with regional implications. In the past 10 years, 369 mergers and acquisitions have been assessed. It is notable that in the food and agriculture sector, these reviews have not blocked any mergers. Significant mergers, such as those between Bayer/Monsanto and ETG/SABIC Agri-Nutrient, have been allowed to proceed.

- Is this a failure of COMESA to regulate the market? Most likely not. Rather, these mergers exemplify how regional authorities depend on national regulators for data. In these cases, the information received may not have been sufficient, leading to erroneous analysis. The strength of COMESA is reflected in the capabilities of national authorities.

- Competition regulators at the national, regional and continental levels provide the building blocks for a thriving and competitive African economy. Effective competition policy and enforcement are prerequisites for open economies, fair trading conditions and a level playing field. In the agrifood sector, competition is essential. Our livelihoods, well-being and food security depend on it.

- Mr. Sampa is the former head of the Competition and Consumer Protection Commission in Zambia from 2011 to 2022. He is an active member of the International Competition Network (ICN), the African Competition Forum (ACF) and the International Consumer Protection Enforcement Network (ICPEN) which he presided in 2018-19.

- Read the original of this report, including embedded links and illustrations, on the African Arguments site.How Continental Competition Policy Strengthens the African Marketplace

Monday, 6 May 2024

Guinness World Records - Nigerian Concludes 115-Hour Ironing Marathon

- The longest marathon ironing record attempt was held at the Jabi Lake Mall in Abuja.

- On Monday, Zahani Kuma, aka Mr Reliable, a Nigerian fashion entrepreneur, completed a 115-hour ironing marathon in a bid to set a new Guinness World Record (GWR).

- Gareth Sanders, a cleaning company manager in Bristol, UK, achieved the longest marathon ironing, 100 hours, from 26 to 30 October 2015.

- Mr Sanders attempted this record at a local Asda Superstore in the UK to raise funds for charity, and it took him over two weeks to fully recover.

- Mr Reliable, who revealed his GWR application was approved in November 2023, began his quest to set the longest marathon ironing record at the Jabi Lake Mall in Abuja from 23 April to 28.

- He said he was inspired to begin the record attempt because he hopes to support children experiencing academic challenges.

- The fashion designer who is awaiting GWR confirmation said: "For five sleepless days and nights, I will be dedicating myself to resilience, endurance, and hard work with the utmost goal of raising a sum of money and supporting in my little way the educational challenges faced by many children within my locality through my profound NGO," he wrote on Instagram.

- "As an orphan at a very young age, my desire for education was vast; even though there was no one to aid me, I persistently pushed my way through. Now, I've taken it upon myself to assist as many children as possible in reaching their full potential.

- "This dream can only be achievable with your full support."

- Mr Reliable's feat follows that of Nigerian Youtuber and social media entrepreneur Clara Kronborg, who broke the Guinness world record for the longest interviewing marathon with a time of 55 hours and 24 seconds last Wednesday.The previous record was 37 hours 44 minutes, achieved in 2022 by Rob Oliver from the United States of America.Guinness World Records - Nigerian Concludes 115-Hour Ironing Marathon

Thursday, 2 May 2024

Five Things Chinese Investment Means for Zimbabwe

- By Fani Zvomuya Correspondent: President Mnangagwa recently toured the Manhize Steel Plant, a bustling investment near Mvuma that is the face of steel manufacturing revival in Zimbabwe; and the lofty position the country will attain as Africa's giant.

- The Manhize Steel Plant is owned by Chinese company Tsingshan Holding's local subsidiary, DINSON Iron and Steel. The steel plant has just begun production of pig iron and will in the course of the year manufacture steel billets and bars, all necessary for the steel industry which supports various sectors of the economy such as construction, agriculture, mining and so on.

- Dinson's Manhize plant will be the biggest in Africa at its peak, according to its projected phases; and this fact bears quite some symbolism, as China helps Zimbabwe to rise from the ashes and become a shining example.

- The country's own steel manufacturing had been battered because of the collapse of a State entity, Ziscosteel; and massive de-industrialisation that has taken place in the past two decades, mostly due to sanctions imposed on Zimbabwe by Western countries. Zisco was among entities initially put under the embargo.

- While addressing stakeholders during the Manhize Steel Plant, the President underlined the importance of Chinese investments in the southern African nation.

- He said: "I applaud companies from the People's Republic of China for the continued investments in our economy. This investment through Dinson Iron and Steel Company signifies more than just financial support; it represents a shared vision for a brighter future between Zimbabwe and China."

- This article unpacks the significance of Chinese investments in Zimbabwe, and the benefits of greater cooperation between the two countries.

- In particular, there are five key attributes of Chinese investments that underline the importance of Chinese foreign direct investment as a function of the comprehensive strategic partnership between the two sides.

- From size and speed, to spreading tentacles in Africa

- The first key attribute of Chinese investments in Zimbabwe, which Manhize steel project signifies is size.

- China is one of Zimbabwe's major source of Foreign Direct Investment, and it is no surprise that the biggest projects that the country has set up have come from China to the Manhize steel project is worth US$1.5 billion.

- What is important to note is that it is at the apex of a value chain comprising of production of ferrochrome and coking coal, which means that Dinson is the only company with such a well-knit business concept, worth close to US$3 billion.

- Dinson sister companies, Afrochine (ferrochrome) and Dinson Colliery (coking coal) have been the major producers and exporters of their respective products in Zimbabwe.

- The Dinson group also owns Gwanda Lithium as it pivots to new energy materials as part of its investment portfolio, which may include other minerals such as copper.

- Size matters. The Tsingshan group, the largest steelmaker and a Fortune 500 company, is showing the extent of Chinese investments in the country.

- There are a number of investments that are also big in size and scale.

- These include two major mining projects in the lithium sector through Sinomine Bikita Lithium, and Zhejiang Huayou Cobalt's Prospect Lithium Zimbabwe which have opened over the past two years.

- The projects were worth close to US$2 billion combined in investments.

- The biggest future and prospective investments in Zimbabwe will likely to be Chinese.

- These include a battery manufacturing plant in Mapinga, Mashonaland West; as well as the US$1 billion floating solar farm in Kariba.

- The second key attribute of Chinese investments in Zimbabwe is speed.

- Many projects done by Chinese companies have been completed in record time, as they have breezed through construction to begin operations quickly and efficiently.

- Rapid progress seen on Chinese projects has been seen by many locals as a thing of marvel.

- It is China speed. Projects such as Prospect Lithium Zimbabwe's Arcadia lithium plant, which was constructed in under one year, when ordinarily it would take at least 18 months, have attested to the sense of urgency and purpose as well as unmatched work ethic of the Chinese.

- The third attribute is that Chinese investments are impactful.

- The impact of Chinese investments has been huge. Zimbabwe has over 100 large and medium scale companies involved in various significant economic endeavours.

- China has also become an employer across various sectors. Apart from providing jobs and steering the economy through revenue streams to the fiscus, Chinese investments have come with social impact through corporate social responsibility assisting communities with education, health and other social needs.

- Sinomine Bikita Minerals has in the past year drilled nearly 40 boreholes in Masvingo Province, as well as upgrading roads. The company will also build a bridge in Manicaland.

- Bikita Minerals has also brought electricity to local businesses and homesteads, which are benefiting from its investment in power infrastructure valued at millions, something similar to what Dinson Iron and Steel has also done through a 90 kilometre 400kva power line from Sherwood in Kwekwe to the plant.

- Bikita Minerals has a football team that won promotion into Zimbabwe's top flight, the Premier Soccer League, underlining the diversity of its impact portfolio, as football is not just a social force but also an employer in itself.

- Chinese companies have also had impact on activities that have enhanced local value chains, becoming a key cog in running Zimbabwe's economy. Add to this, the transfer of skills and technologies that are benefiting local people.

- Fourth, Chinese companies are transformative. Chinese companies are assisting Zimbabwe modernise its economy and pushing industrialisation, with Manhize steel being the metaphor for the industrialisation drive as steel is at the centre of development.

- Historically, steel is a key driver of industrialisation and a Chinese company is at the centre of it all.

- Dinson Iron and Steel managing director, Mr Benson Xui -- captured it succinctly when he described the transformation power of the company's investment, relating that: "I saw mountains of iron ore and saw an opportunity for us to achieve the steel project in Zimbabwe and for Zimbabwe." (This was corroborated by President Mnangagwa stating that, "Over the years, the full potential of our iron ore resources and value chains have remained largely untapped.

- "However, under the Second Republic, the milestones we are realising through exceptional teamwork, focus and determination from both public and private sector have seen the establishment of this national strategic project."

- He also said it was pleasing that Zimbabwe's iron ore will be fully exploited, value added and beneficiated locally so as to realise maximum benefits from local natural resources, while also capitalising on the value chains including processing, manufacturing and the supply of high-value finished steel goods and products.)

- Value addition is key to economic transformation and this is being driven by Tsingshan investments in Zimbabwe, which has lots of natural resources and a yet to be realised value of unmined assets, added to vast human resources, a perfect climate and a huge repository of human capital.

- In this process, there is massive development of infrastructure and support services, which are set to impact on the whole of southern Africa, particularly in the south and south east where a value addition park will be established and attracting interest globally.

- Lastly, Chinese investments in Africa and in Zimbabwe particularly are stimulating and diffusional. Zimbabwe is thus positioned to become a nodal country, placing it firmly at the centre of the region, and becoming the gateway to Africa for investors attracted to opportunities linked to the exploitation and utilisation of natural resources.

- Zimbabwe and Africa are rising, and this fits neatly into the global economic matrices espoused in concepts such as China's Belt and Road Initiative and Global Development Initiative.

- Read the original article on The Herald.Five Things Chinese Investment Means for Zimbabwe

Thursday, 11 January 2024

The BRICS are neither the anti-West nor a bloc

India’s Finance Minister Nirmala Sitharaman at the BRICS Finance Ministers and Central Bank Governors meeting in Washington, D.C. Photo: Twitter @nirmalasitharaman retweet of April 12, 2023 from Indian Ministry of Finance

India’s Finance Minister Nirmala Sitharaman at the BRICS Finance Ministers and Central Bank Governors meeting in Washington, D.C. Photo: Twitter @nirmalasitharaman retweet of April 12, 2023 from Indian Ministry of FinanceWednesday, 1 November 2023

Minister Pravin Gordhan Relaunches South African Airways, 26 Oct

- Date: Thursday, 26 October 2023

- Venue: The Royal Yacht Club, Table Bay Harbour, Cape Town

- Time: 18h00 for 18h30

- Dress Code: Business Casual with a Brazilian FlairAmongst the honored guests will also be Brazil's Vice Minister of Tourism, the Honourable Ana Carla Machado Lopes. Minister Pravin Gordhan Relaunches South African Airways, 26 Oct:

Friday, 27 October 2023

Medicines for Africa - Obasanjo Speaks On UK-India Trade Deal

- President Obasanjo said the UK's proposals will lead to "huge cost increases for health systems and catastrophic delays in accessing medicines".

- Former Nigerian President Olusegun Obasanjo has warned that a UK-India trade deal "will lead to huge cost increases for health systems and catastrophic delays in accessing medicines if British negotiating demands are met."

- The UK wants India to implement sweeping changes to its intellectual property rules as part of any agreement, "threatening India's ability to supply inexpensive quality medicines to the rest of the world."

- In an opinion piece published on devex, Mr Obasanjo describes Indian generics as "a lifeline" which he noted helped to make HIV medicines affordable for African countries.

- He however said "a trade deal between India and the UK could cut short the lifeline."

- "During my time as president of Nigeria, I saw the impact of Indian generics firsthand. In 1999, as I began my second term in office, Nigeria could not afford HIV treatment, even though we were experiencing one of the worst epidemics in Africa at the time," he said.

- "In the early 2000s, Indian generics slashed the price of treatment from more than $10,000 a year per patient to just around $365, a dollar a day. By 2008, India supplied 84 per cent of Nigeria's antiretroviral HIV medicines, saving countless lives."He noted that Nigeria is now one of India's top five importers of pharmaceuticals, spending over half a billion dollars annually.Medicines for Africa - Obasanjo Speaks On UK-India Trade Deal

Tuesday, 3 October 2023

Ban Smoking and Vaping in Schools Worldwide Urges WHO

- Banning nicotine and tobacco products on school campuses

- Prohibiting the sale of products near schools

- Banning direct and indirect ads and promotion of nicotine and tobacco products near classrooms

- Refusing sponsorship or engagement with tobacco and nicotine industries, for instance for school projects.

Friday, 22 September 2023

Tunisia detains cartoonist over drawings mocking prime minister

Tuesday, 5 September 2023

Brazil's president proposes common currency for BRICS nations

- The President of Brazil, Luiz Inacio Lula da Silva, popularly known as Lula, proposed the idea of establishing a common currency among the BRICS nations.

- BRICS is a grouping of the economies of Brazil, Russia, India, China, and South Africa. The predecessor of this group, before South Africa joined the other four in 2010 was known as BRIC.

- President Lula’s proposal aims to mitigate the susceptibility of the economies of most countries to the fluctuations in the value of the US dollar in trade and investment transactions.

- Lula put forth the suggestion on 23 August 2023 during a BRICS summit held in Johannesburg, South Africa.

- However several experts and officials have commented that there are formidable challenges associated with this initiative. Chief among them, they have said, are the significant economic, political, and geographical differences among Brazil, Russia, India, China, and South Africa.

- Lula holds the view that nations not using the dollar should not be compelled to engage in trade using that currency. He expressed support for the implementation of a shared currency within the Mercosur bloc, which comprises South American countries.

- Addressing the opening session of the summit, he stated that a BRICS currency would ‘expand our payment choices and diminish our exposure to vulnerabilities.’

- South African officials had previously stated that the discussion of a BRICS currency was not included in the summit's agenda.

- Back in July, India's foreign minister, S. Jaishankar, had asserted that the concept of a BRICS currency did not exist, and the agenda would include discussions on enhancing trade in the respective national currencies.

- Russian President Vladimir Putin, who participated in the gathering via video link, said the discussions would revolve around transitioning trade between member nations from the dollar to their respective national currencies. On the other hand, China has yet to provide a statement regarding this idea.

- President Xi Jinping, during his address at the summit, emphasized the importance of advancing ‘the reform of the international financial and monetary system.’

- During an interview with a radio station in July this year, Lesetja Kganyago, governor of the South African central bank had described the creation of a BRICS currency as a ‘political endeavor’. Kganyago has emphasized the need to establish of a banking union, a fiscal union, and the attainment of macroeconomic convergence before a common BRICS currency can be created.

- A mechanism for enforcing compliance among countries is required, especially for those that deviate from the established framework. Also, the creation of a common central bank raises the question of its geographical location. Not an easy decision to reach.

- Trade imbalances pose a significant challenge, as highlighted by Herbert Poenisch, a senior fellow at Zhejiang University, in a blog post for the think-tank OMFIF.

- ‘All BRICS member nations primarily engage in trade with China, with minimal trade occurring among themselves.’

- BRICS leaders have expressed their desire to increase the use of their respective national currencies instead of relying heavily on the dollar. This shift has gained prominence, particularly after the substantial strengthening of the dollar last year due to the Federal Reserve's interest rate hikes and Russia's involvement in Ukraine, resulting in increased costs for dollar-denominated debt and imports.

- The sanctions imposed on Russia, leading to its exclusion from the global financial system last year, also heightened speculation that non-Western allies might transition away from the dollar.

- ‘In Tuesday's summit,’ Putin emphasized, ‘the relentless process of reducing our economic dependence on the dollar is gaining traction.’

- According to data from the International Monetary Fund, the dollar’s share of official foreign exchange reserves dropped to a 20-year low of 58% in the last quarter of 2022, and it fell to 47% when accounting for fluctuations in exchange rates.

- Nonetheless, the dollar continues to hold a dominant position in global trade, being involved in one side of nearly 90% of worldwide foreign exchange transactions, as reported by data from the Bank for International Settlements.De-dollarization would necessitate a widespread shift, with numerous exporters, importers, borrowers, lenders, and currency traders worldwide making independent decisions to opt for alternative currencies. Brazil's president proposes common currency for BRICS nations

Tuesday, 2 February 2021

South Africa receives first batch of Covid vaccine