Thursday, 11 December 2025

30,000 Animals Rescued from Illegal Captivity in the Largest Wildlife Trafficking Raid in History

Wednesday, 5 June 2024

Millions of UK adults may have lost money to a financial scam in the last year

Monday, 18 December 2023

It can be hard to challenge workplace discrimination but the government’s new bill should make it easier

Alex Gutierrez worked for MUR Shipping and its predecessors for nearly 30 years. But in 2018 he was told, in line with company policy, it was time to set a retirement date.

Gutierrez was moved to a fixed-term contract, asked to train his replacement and ultimately resigned from his job. He then complained to the Australian Human Rights Commission and brought his claim to court, alleging age discrimination.

He won the case but he also lost.

The court found the company had discriminated. But Gutierrez’s damages – A$20,000 - dwarfed his legal costs, which amounted to about $150,000. The low damages also meant Gutierrez might have to pay MUR’s costs, as the damages were lower than a previous settlement offer.

Gutierrez was the first person to win an age discrimination case in court in the roughly 20 years the federal Age Discrimination Act 2004 has existed and his situation explains why. You can win in court but still be hugely out of pocket for your costs and your employer’s costs. Few people take the risk.

That problem will be largely eliminated under a new government bill before the federal parliament. The bill would introduce a modified “equal access” cost protection provision for discrimination claims.

How changing the law would help

If the bill passes, claimants (workers) will generally recover their costs when their claim is successful. Respondents (employers) cannot generally recover their costs, except in limited circumstances. This could significantly increase the number of workers who are willing to sue over discrimination, of any kind.

Discrimination at work is common: in one survey conducted for the Australian Human Rights Commission, 63% of respondents said they had experienced age discrimination – being considered too young, or too old - in the last five years.

But few people challenge discrimination in the workplace. In my research on age discrimination law, I found people were often concerned about the costs of making a complaint. This includes financial costs, but also personal and emotional costs. People were also worried about the time it might take to resolve.

Costs have been a particular problem under federal discrimination law.

Australia has discrimination laws at state, territory and federal level. Discrimination is also banned under industrial law – the federal Fair Work Act 2009. In every jurisdiction except Victoria, a complaint is first made to a statutory equality agency, which tries conciliation.

In many cases, this succeeds and most claims are resolved, though many are withdrawn.

Conciliation can save time and money

Conciliation is comparatively quick and cheap and lawyers are often not involved because you can represent yourself.

It is when a complaint isn’t resolved at conciliation that the costs increase. In the states and territories, and under the federal Fair Work Act 2009, parties mostly pay their own costs (that is, the cost of a lawyer).

It is different under federal discrimination law. In the federal courts, the losing party generally pays the winning party’s costs. This makes the stakes of a discrimination claim incredibly high: if your claim fails, you may not just have to pay your own legal bill, but also the other side’s legal bill.

The perils of costs were shown by Gutierrez’s case. In Gutierrez v MUR Shipping Australia Pty Limited, despite winning his claim of age discrimination, Gutierrez had to appeal in order to escape punishing legal costs.

Fortunately, Gutierrez had his appeal upheld; his damages were increased to $232,215, so he was no longer liable for the other side’s costs, and he had his appeal costs paid. But not every claim under the current law will be so lucky.

Prohibitive costs can stop people from taking action

Costs make challenging discrimination at work under federal law much more difficult. The human rights commission’s Respect@Work report found the risk of a costs order was a significant “disincentive” to bringing a claim under federal law.

The new bill might remove this disincentive by re-balancing the costs of claiming, enabling many more people to challenge discrimination in the federal courts.

We all have an interest in challenging discrimination and inequality. Research suggests more equal societies are happier and healthier overall. There is a good chance, too, many of us will experience some form of discrimination in our working lives.

Using discrimination law – making a complaint – can benefit us as individuals but can also force broader change. It can lead to policy change and it can force employers to take equality seriously.![]()

Alysia Blackham, Associate Professor in Law, The University of Melbourne

This article is republished from The Conversation under a Creative Commons license. Read the original article.

Friday, 15 December 2023

How risky is it to give card details over the phone and how do I reduce the chance of fraud?

Paul Haskell-Dowland, Edith Cowan University and Ismini Vasileiou, De Montfort University

Paying for things digitally is so common, most of us think nothing of swiping or tapping our card, or using mobile payments. While doing so is second nature, we may be more reluctant to provide card details over the phone.

Merchants are allowed to ask us for credit card details over the phone – this is perfectly legal. But there are minimum standards they must comply with and safeguards to protect consumer data.

So is giving your card details over the phone any more risky than other transactions and how can you minimise the risks?

How is my card data protected?

For a merchant to process card transactions, they are expected to comply with the Payment Card Industry Data Security Standard. This is a set of security requirements designed to protect cardholder data and the trillions of dollars of transactions each year.

Compliance involves various security measures (such as encryption and access controls) together with strong governance and regular security assessments.

If the information stored by the merchant is accessed by an unauthorised party, encryption ensures it is not readable. That means stealing the data would not let the criminals use the card details. Meanwhile, access controls ensure only authorised individuals have access to cardholder data.

Though all companies processing cards are expected to meet the compliance standards, only those processing large volumes are subject to mandatory regular audits. Should a subsequent data leak or misuse occur that can be attributed to a compliance failure, a company can be penalised at levels that can escalate into millions of dollars.

These requirements apply to all card transactions, whether in person, online or over the phone. Phone transactions are likely to involve a human collecting the card details and either entering them into computer systems, or processing the payment through paper forms. The payment card Security Standards Council has detailed guides for best practice:

A policy should be in place to ensure that payment card data is protected against unauthorised viewing, copying, or scanning, in particular on desks.

Although these measures can help to protect your card data, there are still risks in case the details are misplaced or the person on the phone aren’t who they say they are.

Basic tips for safe credit card use over the phone

If you provide card details over the phone, there are steps you can take to minimise the chance you’ll become the victim of fraud, or get your details leaked.

1. Verify the caller

If you didn’t initiate the call, hang up and call the company directly using details you’ve verified yourself. Scammers will often masquerade as a well-known company (for example, an online retailer or a courier) and convince you a payment failed or payment is needed to release a delivery.

Before you provide any information, confirm the caller is legitimate and the purpose of the call is genuine.

2. Be sceptical

If you are being offered a deal that’s too good to be true, have concerns about the person you’re dealing with, or just feel something is not quite right, hang up. You can always call them back later if the caller turns out to be legitimate.

3. Use secure payment methods

If you’ve previously paid the company with other (more secure) methods, ask to use that same method.

4. Keep records

Make sure you record details of the company, the representative you are speaking to and the amount being charged. You should also ask for an order or transaction reference. Don’t forget to ask for the receipt to be sent to you.

Check the transaction against your card matches the receipt – use your banking app, don’t wait for the statement to come through.

Virtual credit cards

In addition to the safeguards mentioned above, a virtual credit card can help reduce the risk of card fraud.

You probably already have a form of virtual card if you’ve added a credit card to your phone for mobile payments. Depending on the financial institution, you can create a new credit card number linked to your physical card.

Some banks extend this functionality to allow you to generate unique card numbers and/or CVV numbers (the three digits at the back of your card). With this approach you can easily separate transactions and cancel a virtual card/number if you have any concerns.

What to do if you think your card details have been compromised or stolen?

It’s important not to panic, but quick action is essential:

call your bank and get the card blocked so you won’t lose any more money. Depending on your situation, you can also block/cancel the card through your banking app or website

report the issue to the police or other relevant body

monitor your account(s) for any unusual transactions

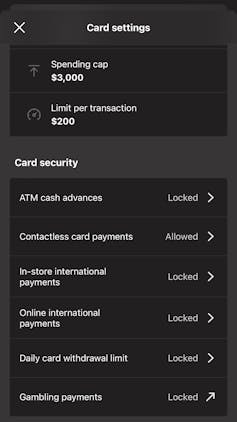

explore card settings in your banking app or website – many providers allow you to limit transactions based on value, restrict transaction types or enable alerts

you may want to consider registering for credit monitoring services and to enable fraud alerts.

So, should I give my card details over the phone?

If you want to minimise risk, it’s best to avoid giving card details over the phone if you can. Providing your card details via a website still has risks, but at least it removes the human element.

The best solution currently available is to use virtual cards – if anything goes wrong you can cancel just that unique card identity, rather than your entire card.![]()

Paul Haskell-Dowland, Professor of Cyber Security Practice, Edith Cowan University and Ismini Vasileiou, Associate Professor, De Montfort University

This article is republished from The Conversation under a Creative Commons license. Read the original article.

Wednesday, 1 November 2023

Indian national in New Jersey admits defrauding companies of millions of dollars of merchandise

- An Indian national admitted August 30, 2023, that he conspired with others to devise a scheme to defraud various telephone providers and insurance companies out of millions of dollars. A press release from U.S. Attorney’s Office for the District of New Jersey says Parag Bhavsar, 42, of Newark, NJ, carried out the fraud by using stolen or fake identities to submit fraudulent claims for replacement cellular devices and then reselling those devices outside the United States

- Bhavsar pleaded guilty before U.S. District Judge Madeline Cox Arleo to an information charging him with one count of conspiracy to commit mail fraud and one count of conspiracy to commit interstate transfer of stolen property.

- According to documents filed in this case and statements made in court, the press release says:

- From June 2013 through June 2019, Bhavsar was involved in a widespread scheme to defraud cellular telephone provider and insurance companies using the U.S. Postal Service mail system, as well as other third-party mail carriers.

- He and his conspirators used stolen and fake identities to submit false claims of lost, stolen or damaged cellular telephones, as well as other devices, in order to obtain replacement devices, the documents say.

- Bhavsar and his conspirators maintained a network of mailboxes and storage units across the United States, including in New Jersey, where the replacement devices would be shipped and then held before being sold to third parties outside the United States.

- The scheme resulted in millions of dollars of losses to the cellular telephone providers and insurance companies, according to the court documents and proceedings.

- The charge of conspiracy to commit mail fraud carries a maximum potential penalty of 20 years in prison and a $250,000 fine, or twice the gain or loss from the offense, whichever is greatest.

- The charge of conspiracy to commit interstate transfer of stolen goods carries a maximum potential penalty of five years in prison and a $250,000 fine, or twice the gain or loss from the offense, whichever is greatest.As part of the plea agreement, Bhavsar will consent to the entry of a forfeiture money judgement of $10.67 million. Sentencing is scheduled for Jan. 3, 2024.Indian national in New Jersey admits defrauding companies of millions of dollars of merchandise

Thursday, 12 October 2023

California dentist pleads guilty to stealing $500,000 in COVID-19 relief money

- The guilty plea was announced by U.S. Attorney for the Eastern District of California Phillip A. Talbert.

- According to the press release which quoted from court records, Rajbanshi ran a dental practice in Bakersfield and Santa Barbara.

- From April 2020 through February 2022, he received more than $850,000 in COVID-19 relief money from the Small Business Administration (SBA) and the U.S. Department of Health and Human Services (HHS). He represented to the government that he would only use the relief money for specified business purposes such as facility costs, payroll, and protective equipment for him and his staff.

- Rajbanshi subsequently used $500,000 of the relief money “for improper personal expenditures such as investments,” the press release said. He has agreed to pay that money back to the government before his sentencing. He is scheduled to be sentenced by U.S. District Judge Ana de Alba on Dec. 4, 2023, when he faces a maximum statutory penalty of 10 years in prison and fine of $250,000. The actual sentence, however, will be determined at the discretion of the court after consideration of any applicable statutory factors and the Federal Sentencing Guidelines, which take into account a number of variables.The Justice Department said anyone with information about allegations of attempted fraud involving COVID-19 can report it by calling the Department of Justice’s National Center for Disaster Fraud (NCDF) Hotline at 866-720-5721 or via the NCDF Web Complaint Form at justice.gov.California dentist pleads guilty to stealing $500,000 in COVID-19 relief money

Monday, 21 August 2023

At least 500 Bahrain prisoners on hunger strike, amid continuation of abuse

- At least 500 prisoners in Bahrain are undergoing a hunger strike in what is said to be the largest such demonstration within the Gulf state’s prison system, amid authorities’ ongoing detention of prisoners of conscience.

- According to The Guardian newspaper, detainees began refusing food on 7 August, with increasing numbers of prisoners having joined the hunger strike throughout the following weeks.

- In a statement from the detainees, which was released through the country’s banned Al-Wefaq opposition party, the hunger strike is being carried out with a series of demands, including an increase to the one-hour per day limit on time outside their cells, the allowance to conduct prayers in congregation at the prison mosque, relieving restrictions on family visits, improvements to education facilities, and access to proper medical and health care.

- “These are not frivolous demands, but necessary ones required for human life,” the prisoners’ statement stressed. The demands come amid increasing reports on the commonness of Bahraini prison authorities’ denial of medical treatment to detainees, the use of solitary confinement, and various other abuses.

- The Bahraini government denied such abuses, however, with its national communication centre telling the paper that it “is committed to protecting human rights and ensuring that international standards are met for all dealings with inmates at its reform and rehabilitation facilities.” The government insisted that the officers and other employees at Jau prison “are fully committed to dealing with inmates in accordance to the law.”

- Authorities also claimed there were no prisoners of conscience held within its system, despite Jau prison reportedly being a site notorious for holding such prisoners and political detainees.

- The office of Bahrain’s interior ministry ombudsman was also quoted as asserting that it has conducted investigations to “ensure the inmates obtain all their rights, whether from health care, visits or contact with their families, and are not being subjected to ill-treatment.”

- According to Sayed Alwadaei, a former inmate at Jau prison and a figure at the Bahrain Institute for Rights and Democracy (Bird), this hunger strike “is probably one of the most powerful strikes that has ever happened inside the Bahraini prison system; the scale of it is overwhelming.”In the tiny Gulf island state, political prisoners reportedly number around 1,200, just under a third of the total prisoner population of 3,800. According to Bird, that means Bahrain has one of the highest incarceration rates per capita in the Middle East. Source: https://www.middleeastmonitor.com/

Wednesday, 16 August 2023

Three more individuals sentenced in $10 million bank fraud

Tuesday, 21 February 2023

CBI Court convicts 09 accused including AGM, Assistant Manager of IDBI Bank for causing 99 Lakh loss to Bank

Thursday, 24 December 2020

Prominent Pakistani rights activist found dead in Canada

Wednesday, 23 December 2020

Corona to Marona! Depositors of Adarsh demand Rs 5000 cr package

Monday, 21 December 2020

आदर्श क्रेडिट के एमडी राहुल और संरक्षक मुकेश माेदी प्रोडक्शन वारंट पर गिरफ्तार

अंबामाता थाना पुलिस जयपुर जेल से लाई, सुखेर-सूरजपाेल में भी दर्ज हैं धाेखाधड़ी के केस आदर्श क्रेडिट काे-ऑपरेटिव साेसायटी के एमडी राहुल माेदी और संरक्षक मुकेश माेदी काे अंबामाता पुलिस ने जयपुर जेल से प्राेडक्शन वारंट पर गिरफ्तार किया है। पूछताछ कर शुक्रवार काे काेर्ट के आदेश पर दोनों को वापस जेल भेजा गया। इनके खिलाफ सुखेर और सूरजपाेल थाने में भी धाेखाधड़ी के मुकदमे दर्ज हैं। अब दाेनाें थाना पुलिस भी प्राेडक्शन वारंट से पूछताछ के लिए गिरफ्तार कर सकती है। अनुसंधान अधिकारी सुल्तान सिंह ने बताया कि 10 सितंबर 2019 काे ओमप्रकाश उपाध्याय, दया भटनागर और मंजू डांगी ने दाेनाें अभियुक्ताें के खिलाफ रिपाेर्ट दर्ज कराई थी। उन्हाेंने बताया था कि फतहपुरा स्थित आदर्श क्रेडिट काॅ-ओपरेटिव कार्यालय में निवेश कर एफडी कराई थी। एफडी परिपक्व की स्टेज पर थी ताे कार्यालय पहुंचे ताे बंद मिला। दाेनाें अभियुक्ताें ने 9.60 लाख रुपए की धाेखाधड़ी की। सुल्तान सिंह ने बताया कि रिपाेर्ट दर्ज हाेने के बाद अनुसंधान शुरु किया था। पता चला था कि एसओजी जयपुर ने दाेनाें अभियुक्ताें काे गिरफ्तार किया था। रिकाॅर्ड देखे ताे पता चला कि आदर्श क्रेडिट काॅ-ओपरेटिव साेसायटी का यूआईटी पुलिया स्थित एक्सिस बैंक में खाता है। कार्यालय में जाे भी एफडी के रूप में राशि जमा कराते थे ताे वह राशि एक्सिट बैंक के खाते में आती थी। इस राशि काे अहमदाबाद उस्मानपुरा स्थित हेड ऑफिस में राशि लाते थे और फिर अलग-अलग जगहाें पर जमीन खरीद निवेश करते थे। 15 राज्याें में वांटेड है दोनों दाेनाें अभियुक्त धाेखाधड़ी के मामलाें में 15 राज्याें में वांटेड है। इन्हाेंने कई जगहाें पर निवेश कर राशि नहीं लाैटाई और उस राशि का उपयाेग जमीनें खरीदने में किया। इनके खिलाफ सूरजपाेल और सुखेर थाने में भी मुकदमे दर्ज है। अंबामाता थाने में परिवादियाें की साझा रिपाेर्ट दर्ज की थी। Source: https://www.bhaskar.com/

14 हजार करोड़ के गबन का मामला:आदर्श घाेटाले के 11 आरोपियों काे जयपुर जेल से गिरफ्तार कर लाई खांडा फलसा पुलिस

19 प्रकरणाें में 2 साल से थे वांछित 5 दिन के रिमांड पर लेकर पूछताछ कर रही पुलिस देशभर में 14 हजार करोड़ रुपए का घोटाला करने वाली आदर्श क्रेडिट को-ऑपरेटिव सोसायटी से जुड़े 11 आरोपियों को खांडा फलसा पुलिस जयपुर जेल से प्रोडक्शन वारंट पर गिरफ्तार कर जोधपुर लाई है। इन सभी को रविवार को कोर्ट में पेश कर पांच दिन के रिमांड पर लिया गया। खांडा फलसा थाने में सोसायटी के खिलाफ 19 प्रकरण दर्ज है, जो पिछले दो सालों से लंबित है। फिलहाल इन मामलों को लेकर सभी से पूछताछ की जा रही है। थानाधिकारी दिनेश लखावत ने बताया कि चौहाबो सेक्टर-17 निवासी ललित कुमार व्यास ने सबसे पहले वर्ष 2019 में आदर्श क्रेडिट कॉपरेटिव सोसायटी के पदाधिकारियों के खिलाफ रिपोर्ट दर्ज करवाई थी। इसके बाद 18 और प्रकरण दर्ज किए गए। मामले में काफी लोगों को एसओजी ने गिरफ्तार कर जेल भिजवाया था। अब प्रकरणों की जांच के लिए पुलिस को आदेश जारी हुए है। इस पर 11 आरोपियों को जयपुर जेल से प्रोडक्शन वारंट पर गिरफ्तार किया गया। इन्हें गिरफ्तार कर लाया गया सोसायटी से जुड़े सुनारवाड़ा सिरोही निवासी समीर पुत्र भरत मोदी, भरत पुत्र देवीचंद मोदी, देवनगरी सिरोही निवासी विवेक पुत्र प्रकाशचंद्र पुरोहित, मोदी लाइन सिरोही निवासी रोहित पुत्र वीरेंद्र मोदी, आदर्श नगर रोड सिरोही निवासी भरतदास पुत्र मानदास वैष्णव, वैशालीनगर जयपुर निवासी राजेश्वरसिंह पुत्र महावीरसिंह, भगत की कोठी जोधपुर निवासी वैष्णव पुत्र दिनेश कुमार लोढ़ा, सोसायटी के अध्यक्ष आदर्श नगर सिरोही निवासी ईश्वरसिंह सिंदल पुत्र रणजीतसिंह, वीरेंद्र पुत्र प्रकाशराज मोदी, बांद्रा मुंबई निवासी प्रियंका पत्नी वैभव मोदी और गोरा छपरा माउंटआबू निवासी ललिता पुरोहित पुत्री हिम्मतसिंह राजपुरोहित को जयपुर जेल से प्रोडक्शन वारंट पर गिरफ्तार किया गया।Source: https://www.bhaskar.com/

Tuesday, 15 December 2020

‘Killing of Irani scientist is insane, provocative and illegal’

83 more Taliban killed in clashes with Afghan forces

Man kills 9 people contacting them on Twitter, sentenced to death

Monday, 14 December 2020

Pak violates ceasefire in two sectors along LoC and IB in J&K

DEC 13, 2020 JAMMU: Pakistani troops violated ceasefire by resorting to unprovoked firing and mortar shelling on forward posts and villages in two sectors along the Line of Control (LoC) and International Border (IB) in Jammu and Kashmir''s Poonch and Kathua districts, officials said on Sunday. Indian forces retaliated befittingly to silence the Pakistani guns, the officials said, adding that there was no report of any casualty on the Indian side. "At about 5.45 pm (Sunday), Pakistan (Army) initiated unprovoked ceasefire violation by firing with small arms and shelling mortars along the LoC in Degwar sector of Poonch," a defence spokesman said. He said the Indian army retaliated befittingly and the cross-border shelling between the two sides was going on when last reports were received. Pakistani Rangers also opened fire on forward posts and villages along the IB in Kathua district of Jammu region, the officials said. They said the firing from across the border in the Pansar border outpost area in Hiranagar sector started around 10 pm on Saturday, drawing strong and effective retaliation from the Border Security Force (BSF). The cross-border firing between the two sides continued till 3.45 am on Sunday, forcing border residents to spend the night in underground bunkers, the officials said. Copyright © Jammu Links News, Source: Jammu Links News

Sunday, 13 December 2020

3 कोऑपरेटिव सोसाइटियों में 17 हजार करोड़ का फ्रॉड, एक संचालक की बेटी की सैलरी मुकेश अंबानी से भी 75 लाख रुपए ज्यादा

- राजस्थान की 3 सोसाइटियों के खिलाफ एसओजी की 96 हजार पेज की चार्जशीट पर भास्कर का सबसे बड़ा खुलासा

- आदर्श क्रेडिट साेसाइटी के 20 लाख निवेशकों से धोखाधड़ी, यह देश का सबसे बड़ा कोऑपरेटिव घोटाला: पुलिस

Gunmen kill 34 people in west Ethiopia

- Gunmen killed at least 34 people in a "gruesome" attack on a passenger bus in west Ethiopia, a part of the country that has recently seen a spate of deadly assaults on civilians, the national human rights body said Sunday.

- The Ethiopian Human Rights Commission (EHRC) said in a statement that "the estimated number of casualties, currently at 34, is likely to rise" from the attack which occurred Saturday night in the Benishangul-Gumuz region.

- A spokesman for the commission, an independent government body, confirmed that the casualties were all deaths.

- The EHRC statement said the bus attack occurred in the Debate administrative area, and that "there are reports of similar attacks" in three other areas, as well as "of persons who have fled to seek shelter".

- Prime Minister Abiy Ahmed's government has provided scant information on recent violence in Benishangul-Gumuz, particularly in Metekel zone, where Debate is located.

- Twelve people were killed in an attack in the zone in October, while 15 died in a similar attack in late September.Addressing lawmakers in October, Abiy said fighters responsible for the killings were receiving training and shelter in neighbouring Sudan and that Khartoum's assistance was needed to stabilise the area. Source: https://www.daily-bangladesh.com

IC Exclusive: Adarsh Liquidator cannot act due to ED attachment

|

. |

H S Patel, the man who is at the centre of attention of lakhs of depositors of the beleaguered Adarsh Credit Co-operative has talked to Indian Cooperative explaining the challenges being faced by him in doing justice to the job on hand-that is an amicable resolution of the dispute of Adarsh Credit Cooperative Society.