IANS: The baby-food brands sold by global giant Nestle in India contain high levels of added sugar, unlike the same products in the UK, Germany Switzerland, and other developed nations, revealed an investigation by Swiss organisation Public Eye and the International Baby Food Action Network (IBFAN), sparking concern in the country at the violation of health guidelines.

IANS: The baby-food brands sold by global giant Nestle in India contain high levels of added sugar, unlike the same products in the UK, Germany Switzerland, and other developed nations, revealed an investigation by Swiss organisation Public Eye and the International Baby Food Action Network (IBFAN), sparking concern in the country at the violation of health guidelines.Saturday, 4 May 2024

Nestle baby food sugar study causes concern in India, Nestle India's shares fall

IANS: The baby-food brands sold by global giant Nestle in India contain high levels of added sugar, unlike the same products in the UK, Germany Switzerland, and other developed nations, revealed an investigation by Swiss organisation Public Eye and the International Baby Food Action Network (IBFAN), sparking concern in the country at the violation of health guidelines.

IANS: The baby-food brands sold by global giant Nestle in India contain high levels of added sugar, unlike the same products in the UK, Germany Switzerland, and other developed nations, revealed an investigation by Swiss organisation Public Eye and the International Baby Food Action Network (IBFAN), sparking concern in the country at the violation of health guidelines.Monday, 6 November 2023

Reliance to invest $122 million in Brookfield JV for data center projects in India

FILE PHOTO: Labourers rest in front of an advertisement for Reliance Industries at a construction site in Mumbai, India, March 2, 2016. REUTERS/Shailesh Andrade/File Photo

FILE PHOTO: Labourers rest in front of an advertisement for Reliance Industries at a construction site in Mumbai, India, March 2, 2016. REUTERS/Shailesh Andrade/File PhotoTuesday, 3 October 2023

CRISIL predicts an 8-10% revenue growth for Indian pharma industry in current fiscal year

- According to a report, the Indian pharmaceutical industry is expected to achieve 8 to 10 per cent revenue growth in the current fiscal year. This growth will be driven by expansion in the domestic market and increased exports to regulated markets. However, semi-regulated markets may encounter challenges, the report said.

- A study conducted on 186 pharmaceutical companies, which collectively contributed to approximately half of the sector’s annual revenue of Rs.3.7 trillion in the last fiscal year, supports these findings, as reported by CRISIL on Monday, 11 September 2023.

- CRISIL research director Aniket Dani noted that, similar to the previous fiscal year, domestic growth in fiscal year 2024 will primarily stem from a 5-6 per cent increase in realizations. This increase will be partially due to substantial price hikes allowed by the National Pharmaceutical Pricing Authority (NPPA) for drugs under price regulation. And sales of existing drugs and new product launches are expected to drive a 3-4 per cent growth in volume.

- The industry’s operating profitability is also expected to improve by 50-100 basis points (bps) to reach 21 per cent this fiscal year. This improvement will be supported by reduced input and logistics costs, as well as a decrease in pricing pressure in the US generics market, compared to the challenging conditions experienced in the past two years.

- CRISIL pointed out that the previous years saw margin contraction due to high pricing pressure in the US and a sharp increase in input costs caused by supply chain disruptions during the Covid pandemic.

- The credit profiles of pharmaceutical companies are expected to remain stable, thanks to their low-leveraged balance sheets and moderate capital expenditure plans.

- In the ongoing fiscal year, domestic sales are projected to grow by 8–10 per cent, with the chronic segment expected to be the primary contributor to revenues. This is attributed to the ongoing rise in lifestyle-related diseases and a continued focus on health awareness following the pandemic.

- Formulation exports are anticipated to increase by 7-9 per cent in rupee terms in the current fiscal year, driven by higher volumes resulting from new product launches and a reduction in price pressure in the US generics market. However, increased claw-back of taxes in select European markets may lead to slower growth in exports to Europe.

- CRISIL also said that exports to Asia are expected to improve this fiscal year, following modest growth in the previous year. Meanwhile, exports to Africa are likely to remain sluggish due to low foreign exchange reserves impacting purchasing power and high currency volatility.The industry is also expected to see reduced inventories and smaller incremental working capital debt this fiscal year, thanks to lower input prices and the normalization of supply chains compared to the pandemic-affected period.CRISIL predicts an 8-10% revenue growth for Indian pharma industry in current fiscal year

Tuesday, 26 September 2023

From stock markets to brain scans, new research harmonises hundreds of scientific methods to understand complex systems

University of SydneyComplexity is all around us, from the daily fluctuations of financial markets to the intricate web of neurons in our brains.

Understanding how the different components of these systems interact with each other is a fundamental challenge for scientists trying to predict their behaviour. Piecing together these interactions is like deciphering a code from an intricate set of clues.

Scientists have developed hundreds of different methods for doing this, from engineers studying noisy radio channels to neuroscientists studying firing patterns in networks of interacting neurons. Each method captures a unique aspect of the interactions within a complex system – but how do we know which method is right for any given system sitting right in front of us?

In new research published in Nature Computational Science, we have developed a unified way to look at hundreds of different methods for measuring interaction patterns in complex systems – and working out which ones are most useful for understanding a given system.

A scientific orchestra

The science of complex systems can be, well, complex. And the science of comparing and combining different ways of studying these systems even more so.

But one way to think about what we’ve done is to imagine each scientific method is a different musical instrument playing in a scientific orchestra. Different instruments are playing different melodies with different tones and in different styles.

We wanted to understand which of our scientific instruments are best suited to solving which types of problems. We also wanted to know whether we could conduct all of the instruments to form a harmonious whole.

By presenting these methods as a full orchestra for the first time, we hoped we would find new ways of deciphering patterns in the world around us.

Hundreds of methods, more than 1,000 datasets

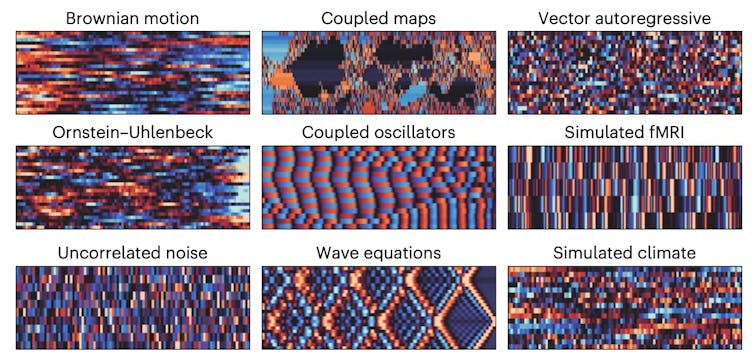

To develop our orchestra, we undertook the mammoth task of analysing more than 200 methods for computing interactions from as many datasets as we could get our hands on. These covered a huge range of subjects, from stock markets and climate to brain activity and earthquakes to river flow and heart beats.

In total, we applied our 237 methods to more than 1,000 datasets. By analysing how these methods behave when applied to such diverse scientific systems, we found a way for them to “play in harmony” for the first time.

In the same way that instruments in an orchestra are usually organised as strings, brass, woodwind and percussion, scientific methods from areas like engineering, statistics and biophysics also have their traditional groupings.

Applying different methods to more than 1,000 datasets from a wide range of fields revealed surprising similarities and differences. Cliff et al. / Nature Computational Science, CC BY-SA

Applying different methods to more than 1,000 datasets from a wide range of fields revealed surprising similarities and differences. Cliff et al. / Nature Computational Science, CC BY-SABut when we organised our scientific orchestra, we found that the scientific instruments grouped together in a strikingly different way to this traditional organisation. Some very different methods behaved in surprisingly similar ways to one another.

This was a bit like discovering that the tuba player’s melody was surprisingly similar to that of the flute, but no one had noticed it before.

Our weird and wonderful new orchestral layout (which sometimes places cello and trumpet players next to the piccolo player), represents a more “natural” way of grouping methods from all across science. This opens exciting new avenues for cross-disciplinary research.

The orchestra in the real world

We also put our full scientific orchestra to work on some real-world problems to see how it would work. One of these problems was using motion data from a smartwatch to classify activities like “badminton playing” and “running”; another was distinguishing different activities from brain-scan data.

Properly orchestrated, the full ensemble of scientific methods demonstrated improved performance over any single method on its own.

To put it another way, virtuosic solos are not always the best approach! You can get better results when different scientific methods work cooperatively as an ensemble.

The scientific ensemble introduced in this work provides a deeper understanding of the interacting systems that shape our complex world. And its implications are widespread – from understanding how brain communication patterns break down in disease, to developing improved detection algorithms for smartwatch sensor data.

Time will tell what new music scientists will make as they step up to conduct our new scientific orchestra that simultaneously incorporates diverse ways of thinking about the world.![]()

Ben Fulcher, Senior Lecturer, School of Physics, University of Sydney

This article is republished from The Conversation under a Creative Commons license. Read the original article.

Friday, 15 September 2023

Tata Consumer Products engages in discussions to acquire majority 51% stake in Haldiram's

- The consumer division of the Tata Group has begun negotiations to acquire a minimum of 51% ownership in the well-known Indian snack food manufacturer, Haldiram’s.

- If the negotiations are successfully finalized, this agreement would position the Indian conglomerate in direct competition with Pepsi and billionaire Mukesh Ambani’s Reliance Retail.

- Haldiram’s, a renowned name in Indian households, is reportedly in discussions with private equity firms, including Bain Capital, regarding the potential sale of a 10% stake, as per their statements.

- Haldiram’s is an Indian multinational corporation specializing in sweets, snacks, and restaurants, with its headquarters situated in Noida. The company operates manufacturing facilities in diverse locations, including Nagpur, New Delhi, Gurgaon, Hooghly, Rudrapur, and Noida.

- In addition to its manufacturing operations, Haldiram’s maintains an extensive network of retail stores and a variety of restaurants located in Pune, Nagpur, Raipur, Kolkata, Noida, and Delhi.

- Haldiram’s, a family-run enterprise, can trace its roots to a small shop established in 1937 in Bikaner in what is today Rajasthan state1937. It The firm has gained widespread recognition for its crispy ‘bhujia’ snack, available for as low as Rs.10, rupees and widely distributed through local mom-and-pop stores as well as supermarkets.

- Haldiram’s snacks are also available in international markets, including Singapore and the United States.

- Additionally, tThe company operates approximately 150 restaurants, offering a diverse range of local cuisine, sweets, and Western dishes.

- Tata Consumer Products is an Indian company specializing in fast-moving consumer goods and is a subsidiary of the Tata Group. While its registered office is situated in Kolkata, its corporate headquarters is based situated in Mumbai. The company holds the distinction of being is the world’s second-largest producer and distributor of tea, and it is also a significant player in the coffee industry.

- Tata Consumer Products is the owner of the UK tea brand Tetley and a strategic partner of Starbucks in India.

- According to some sources, Tata’s intention is to acquire more than 51%, but they have communicated to Haldiram’s that the latter’s ir proposed terms are considerably high.

- Reports indicate that Haldiram’s is reported to have has set a valuation of $10 billion for the stake sought by Tata Consumer Products.

- The prospective acquisition presents an enticing opportunity for Tata, as Tata Consumer is primarily known as a tea company, whereas Haldiram’s holds a significant presence in the consumer sector and commands a substantial market share.

- Haldiram’s holds approximately a 13% share of India’s $6.2 billion savory snack market, as reported by Euromonitor International.

- Whether this deal will happen or collapse will depend on the determination of both parties. Meanwhile, Haldiram’s CEO, Krishan Kumar Chutani, and Bain Capital declined to offer any comments.Haldiram’s has also officially denied any reports of negotiations with Tata Consumer Products. Tata Consumer Products engages in discussions to acquire majority 51% stake in Haldiram's

Thursday, 14 September 2023

Alibaba stock plummets as former CEO abruptly departs cloud unit just before IPO

- Alibaba’s stock on the Hong Kong stock exchange dropped more than 4% on Monday, 11 September 2023, following the unexpected resignation of Daniel Zhang, the former CEO of the Alibaba Group, from his role in the company’s cloud computing division.

- The abrupt resignation has left investors unsettled and raised concerns about its potential impact on the subsidiary’s plans for an initial public offering (IPO) in the coming year.

- A mere two months after focusing solely on the cloud division, Zhang’s departure has paved the way for Eddie Wu, the newly appointed CEO of the Alibaba Group, to step in as the acting CEO and chairman of the cloud unit. This change comes at a challenging time for the Cloud Intelligence Group, which has been grappling with sluggish sales growth, which does not augur well for its planned IPO next year.

- The Cloud Intelligence Group holds a significant position within Alibaba, being the second-largest revenue source after domestic e-commerce. It contains some crucial assets, such as the generative artificial intelligence model Tongyi Qianwen and the messaging app Dingtalk.

- The unit experienced a 2% drop in revenue in the January–March period due to delayed projects and other factors. Analysts estimate it to be China’s largest cloud provider with a 34% market share.

- Despite facing these challenges, the cloud unit is on track for a substantial IPO, with an estimated value ranging from $41 billion to $60 billion.

- Meanwhile, concerns loom that the unit’s extensive data management responsibilities could draw regulatory scrutiny, especially in the light of growing concerns over data security and geopolitics.

- Alibaba has stated its commitment to proceeding with the spinoff of the cloud unit under a yet-to-be-named management team. The process is expected to be completed by May 2024.

- Citi analyst Alicia Yap noted that Zhang’s departure could have a temporary impact on Alibaba’s share price until a successor is appointed. She expressed concerns about the timing and process of AliCloud’s spinoff.

- Zhang, who succeeded Alibaba co-founder Jack Ma as group CEO in 2015 and chairman in 2019, assumed leadership of the cloud unit in December following a significant service outage. However, his tenure as group head was marked by intense regulatory scrutiny. His departure is seen by some, including Vey-Sern Ling, managing director at Union Bancaire Privee, as an opportunity for the cloud business to reset and start anew.

- Alibaba’s stock price fell by as much as 4.4% to HK$86.85, marking its lowest point since August 23. Ling has cautioned investors that the stock remains vulnerable to macroeconomic and geopolitical pressures.

- Alibaba made the announcement of Zhang’s departure from the cloud unit in a letter to staff on Sunday without specifying the reasons behind his decision. It was on the same day that Zhang was scheduled to pass on the group CEO role to Wu and the chairmanship to co-founder Joseph Tsai.

- Eddie Wu, one of Alibaba’s 18 co-founders, who began as a technology director in 1999 and now holds various key positions within the company, including CEO and chairman of Taobao and Tmall Group, as well as directorships in its Local Service Group and Alibaba International Digital Commerce Group, has been appointed to lead the cloud unit. Wu’s appointment is seen as a positive move for Alibaba, as he is closely aligned with Jack Ma and brings fresh energy to the business, according to Union Bancaire’s Ling.Alibaba stock plummets as former CEO abruptly departs cloud unit just before IPO

Wednesday, 9 August 2023

Prosus terminates PayU's $4.7 billion deal to acquire BillDesk

Friday, 21 July 2023

Market predator Hindenburg preys on Adani stock

Wednesday, 22 March 2023

Silicon Valley Bank, sixteenth-largest US bank, collapses

Thursday, 2 March 2023

Adobe to acquire Figma in $20bn cash-and-stock deal

Wednesday, 12 October 2022

Global recession risk up in 2023 amid parallel rate hikes: World Bank

Tuesday, 29 December 2020

Apple loses $81 billion of market value as 5G iPhone 12 launched

Saturday, 26 December 2020

Sensex jumps over 200 pts after RBI policy outcome; financial stocks rise

OCT 09, 2020 MUMBAI: Equity benchmark Sensex jumped over 200 points in the morning session on Friday after the Reserve Bank of India (RBI) monetary policy announcement. RBI has decided to keep benchmark interest rate unchanged at 4 per cent but retained an accommodative stance, implying more rate cuts in the future if the need arises to support the economy hit by the COVID-19 crisis. After announcement of the monetary policy review, the 30-share BSE index was trading 235.28 points or 0.59 per cent higher at 40,417.95, and the NSE Nifty rose 57.15 points or 0.48 per cent to 11,891.75. HDFC was the top gainer in the Sensex pack, rising around 3 per cent, followed by ICICI Bank, L&T, Bajaj Finance, HDFC Bank, Bajaj Finserv, SBI and Axis Bank. On the other hand, Asian Paints, Tech Mahindra, HUL, Bajaj Auto and TCS were among the laggards. Rate-sensitive banking and financial stocks were trading on a positive note, with BSE bankex and finance rising up to 1.68 per cent. Realty index was also quoting gains, while auto was in the red. According to traders, RBI's decision was on expected lines. The benchmark repurchase (repo) rate has been left unchanged at 4 per cent, RBI Governor Shaktikanta Das said while announcing the decisions taken by the Monetary Policy Committee (MPC). Consequently, the reverse repo rate will also continue to earn 3.35 per cent for banks for their deposits kept with RBI. Das said the Indian economy is entering into a decisive phase in the fight against coronavirus. He also stated that the contraction in economic growth witnessed in the April-June quarter of the fiscal is "behind us" and that silver linings are visible. Copyright © Jammu Links News, Source: Jammu Links News

Thursday, 22 December 2016

How Education Influences Pune’s Property Market

Thursday, 13 October 2016

2016 to be record-breaker for Indian IPO collections: study

- The Indian Initial Public Offerings (IPO) market is set to hit a six-year high with $2.93 billion already completed and another $2.90 billion in the pipeline. Financials, insurance, telecommunications, manufacturing, consumer products and services and healthcare are set to be the busiest sectors in the next 12 months.

- The flurry of IPO activity is likely to continue well into 2017, driven by upbeat economic sentiment, improved business confidence, easing inflationary pressure and stable foreign direct investment inflows, according to a research by Baker & McKenzie.

- This year (2016) is set to be a record-breaking year for the Indian IPO market, which is the highest since 2011, it added.

- To date, 50 companies have raised $2.93 billion, while another 22 companies are lined up for about $5.8 billion, more than double last year's total deal value of $2.18 billion from 71 listings.

- A further 16 companies are in the pipeline to be listed domestically in 2017, raising as much as $5.86 billion, including Vodafone's highly anticipated $3 billion IPO, which could potentially surpass state-run Coal India's IPO in 2010 to become India's biggest IPO.

- Momentum in the India IPO market continues to build, boosted by Prime Minister Narendra Modi's drive to cut bureaucratic red tape to improve the ease of doing business in India. These efforts include a rationalisation of the country's current tax regime, where a good is often taxed multiple times at different rates, whether it be at the production and investment stage or during interstate trading.

- The recently passed Goods & Services Tax (GST) Bill, which will take effect on 1 April 2017, will unite India as an efficient common tax market for the first time. This will also have a positive long-term impact on the Indian economy. The implementation of the GST Bill is expected to boost India's GDP growth by as much as two percentage points, according to finance minister Arun Jaitley.

- Ashok Lalwani, head of Baker & McKenzie's India Practice, believes that India will significantly benefit from the GST Bill. "The GST Bill will not only bring about the immediate benefit of widening the country's tax base and improving the revenue productivity of domestic indirect taxes, but more importantly, it sends the message to the people of India and the rest of the world that the Indian government is committed to the country's economic reform, further bolstering India's attractiveness as an investment destination," said Lalwani.

- Domestic vs Cross-border IPOs

- Domestic listings continue to dominate India's IPO scene. Dual listing on both BSE and NSE accounted for 98.8 per cent of Indian companies' listings by value in 2016 to date, raising a total of $2.9 billion from 19 IPOs. These included ICICI Prudential Life Insurance's $909 million IPO, which is the country's biggest IPO this year. A total of 33 companies are expected to dual list on both the BSE and the NSE by the end of 2016, raising a total of $4.62 billion.

- Improved business confidence is also driving Indian companies to look at growth and market expansion opportunities overseas by way of cross-border IPOs. This provides a means to access risk capital that is not available in India, and also to connect with investors who better understand and appreciate their businesses.

- Among the 22 IPOs in the 2016 pipeline is Strand Life Sciences' listing on NASDAQ, which if it goes ahead, will be India's first cross-border IPO since early 2015 when Videocon d2h listed on NASDAQ.

- A number of mega IPO such as Vodafone's $3 billion IPO and PNB Finance Housing Ltd's $388.45 million IPO are also expected to fructify.

- The healthcare and consumer products and services sectors also have a healthy deal pipeline with a total of 22 deals expected to debut in 2016-2017. These deals include Aster DM Healthcare's $176 million IPO and Varsity Education Management's $296 million IPO, which in part reflect the growing middle class demand for higher-end consumer products and better healthcare services.

- The flurry of IPO is likely to continue for the rest of 2016 and well into 2017, driven by upbeat economic sentiment, improved business confidence, easing inflationary pressure and stable foreign direct investment inflows.

- Also both BSE and the NSE announced plans to list their own shares via IPO after the Union Cabinet raised the foreign shareholding limit in Indian stock exchanges to 15 per cent from 5 per cent. This will also help deepen Indian capital markets.

- More listings in the insurance sector could be on the horizon, particularly after the Indian government passed a bill last year which increased the foreign ownership threshold in the nation's insurers to 49 per cent from 26 per cent.

- Equally significant, the Insurance Regulatory and Development Authority of India released a discussion paper in August 2016, proposing to make IPOs mandatory for all general insurance companies that have been in operation for eight years or more as well as for all life insurers that have been operating for 10 years or more.

- "The insurance sector is definitely one to watch out for, although IPO momentum will be heavily influenced by the post-listing performance of ICICI Prudential Life Insurance and the readiness of the insurance companies to hit the market," Lalwani added. Source: domain-b.com

Sunday, 28 August 2016

Fast-growing IoT sector turns imagination into reality

- BY KIM MI-RAE (INFO@KOREAITTIMES.COM) "All intelligent thoughts have already been thought; what is necessary is only to try to think them again," said Johann Wolfgang von Goethe, one of the greatest German writers. If he were alive today in this 21st century, he would recant what he had said. Even the insightful quote from one of the rare giants of world literature rings hollow in the 21st century.

- At a time when autonomous cars and drone-based delivery services are nearing commercialization, our imagination is becoming a reality. The Internet of things (IoT) is evolving every day, so few could predict what kind of ‘intelligent thoughts’ will be thought tomorrow.

- The IoT market is expanding day by day. As advances in IoT technology are being made, the term Internet of Everything (IoE) has been newly coined.

- Though the IoT is most heavily exploited in seven industrial sectors -- automobile, mobile, robotics, security, medicine, the environment and ubiquitous sensor networks, it is fiar to say that the IoT has become relevant across all industries. In particular, sensor technology, the key to the IoT, is spearheading the convergence of heterogeneous industries by enabling smart cars, smart homes and wearable devices.

- The IoT technology that is most relevant to our daily lives is smart home services. Last year, South Korea mobile operator LG U+ kicked off a home IoT service called ‘@Home,’ which lets users to turn off the gas valve, adjust indoor temperatures or control door locks via their smartphones. LG U+ is scheduled to launch ‘Door Cam,’ a CCTV camera service which detects people coming up to your front door, lets you check via your smartphone and stores the footage in the cloud to allow you to watch at any time.

- Samsung Electronics has recently unveiled the Family Hub™ refrigerator with a Wifi enabled touchscreen that lets you manage your groceries, connect with your family and entertain like never before. The fridge comes equipped with Internet-connected cameras that can let you view what's inside without opening the doors. The Family Hub also comes with two apps that let you order food directly from the screen.

- Bicycle manufacturer Alton Sports and software developer HandySoft are planning to launch a GPS-enabled bicycle with Bluetooth sensors attached.

- The IoT project between Alton Sports and HandySoft has drawn great attention as it is carried out in a partnership between SMEs, not between a conglomerate and one of the nation’s three major telecom operators. The GPS-enabled bicycle will enable systemic management of production and sales records and allow the rider to find the nearest Alton Sports for a repair and find and recover your bike after it has been stolen or lost.

- The 4th Industrial revolution driven by smart home services, smart home appliances and wearables

- At the “Lucky Chouette” outlet in COEX mall, southern Seoul, there’s a smart mirror that interacts with every smart hanger to provide a shopper with information on a piece of clothing, from the price and material to photos of a model wearing the clothing. The mirror also doubles as a video camera, capturing a 360 degree view of what an outfit looks like.

- On the accommodation front, there is motel booking app Yanolja which is based on an IoT-based keyless check-in system. Customers of Kotels (Yanolja’s franchise motels) can bypass the front desk when they get to their motel, taking control of everything through the app. Customers will soon be able to do more through the app, such as booking a taxi, requesting free amenities, paying for overstaying check-out and controlling the TV, air conditioner and lights.

- Also underway is an IoT-based urban project designed to address various urban problems. The South Korean government plans to build a test bed for IoT services in Bukchon Hanok Village, a popular tourist attraction where residents frequently file complaints about traffic congestions, garbage and noise problems. The government plans to exploit IoT technology in addressing illegal parking and garbage problems and to install fire detection sensors and public WiFi networks. On top of that, beacons (which detect the presence of smartphones within their range, and can deliver content to those devices, with the permission of the user) will be installed to offer tourist guides and useful traveler information via smartphone when tourists pass through certain sections. Source: http://www.koreaittimes.com

Monday, 22 August 2016

Fast-growing IoT Sector Turns Imagination into Reality

- BY KIM MI-RAE (INFO@KOREAITTIMES.COM) "All intelligent thoughts have already been thought; what is necessary is only to try to think them again," said Johann Wolfgang von Goethe, one of the greatest German writers. If he were alive today in this 21st century, he would recant what he had said. Even the insightful quote from one of the rare giants of world literature rings hollow in the 21st century.

- At a time when autonomous cars and drone-based delivery services are nearing commercialization, our imagination is becoming a reality. The Internet of things (IoT) is evolving every day, so few could predict what kind of ‘intelligent thoughts’ will be thought tomorrow.

- The IoT market is expanding day by day. As advances in IoT technology are being made, the term Internet of Everything (IoE) has been newly coined.

- Though the IoT is most heavily exploited in seven industrial sectors -- automobile, mobile, robotics, security, medicine, the environment and ubiquitous sensor networks, it is fiar to say that the IoT has become relevant across all industries. In particular, sensor technology, the key to the IoT, is spearheading the convergence of heterogeneous industries by enabling smart cars, smart homes and wearable devices.

- The IoT technology that is most relevant to our daily lives is smart home services. Last year, South Korea mobile operator LG U+ kicked off a home IoT service called ‘@Home,’ which lets users to turn off the gas valve, adjust indoor temperatures or control door locks via their smartphones. LG U+ is scheduled to launch ‘Door Cam,’ a CCTV camera service which detects people coming up to your front door, lets you check via your smartphone and stores the footage in the cloud to allow you to watch at any time.

- Samsung Electronics has recently unveiled the Family Hub™ refrigerator with a Wifi enabled touchscreen that lets you manage your groceries, connect with your family and entertain like never before. The fridge comes equipped with Internet-connected cameras that can let you view what's inside without opening the doors. The Family Hub also comes with two apps that let you order food directly from the screen.

- Bicycle manufacturer Alton Sports and software developer HandySoft are planning to launch a GPS-enabled bicycle with Bluetooth sensors attached.

- The IoT project between Alton Sports and HandySoft has drawn great attention as it is carried out in a partnership between SMEs, not between a conglomerate and one of the nation’s three major telecom operators. The GPS-enabled bicycle will enable systemic management of production and sales records and allow the rider to find the nearest Alton Sports for a repair and find and recover your bike after it has been stolen or lost.

- The 4th Industrial revolution driven by smart home services, smart home appliances and wearables

- At the “Lucky Chouette” outlet in COEX mall, southern Seoul, there’s a smart mirror that interacts with every smart hanger to provide a shopper with information on a piece of clothing, from the price and material to photos of a model wearing the clothing. The mirror also doubles as a video camera, capturing a 360 degree view of what an outfit looks like.

- On the accommodation front, there is motel booking app Yanolja which is based on an IoT-based keyless check-in system. Customers of Kotels (Yanolja’s franchise motels) can bypass the front desk when they get to their motel, taking control of everything through the app. Customers will soon be able to do more through the app, such as booking a taxi, requesting free amenities, paying for overstaying check-out and controlling the TV, air conditioner and lights.

- Also underway is an IoT-based urban project designed to address various urban problems. The South Korean government plans to build a test bed for IoT services in Bukchon Hanok Village, a popular tourist attraction where residents frequently file complaints about traffic congestions, garbage and noise problems. The government plans to exploit IoT technology in addressing illegal parking and garbage problems and to install fire detection sensors and public WiFi networks. On top of that, beacons (which detect the presence of smartphones within their range, and can deliver content to those devices, with the permission of the user) will be installed to offer tourist guides and useful traveler information via smartphone when tourists pass through certain sections. Source: http://www.koreaittimes.com

Thursday, 19 November 2015

Markets end mixed on US jobs report